—— Are you tired of constantly hearing generic disingenuous bullshit? I sure am. Everybody wants […]

Startup Opportunism – Watch Out For The Double-Edged Sword

TL;DR – Opportunities present themselves quite often, sometimes ones that sound very appealing and “sexy”, however, […]

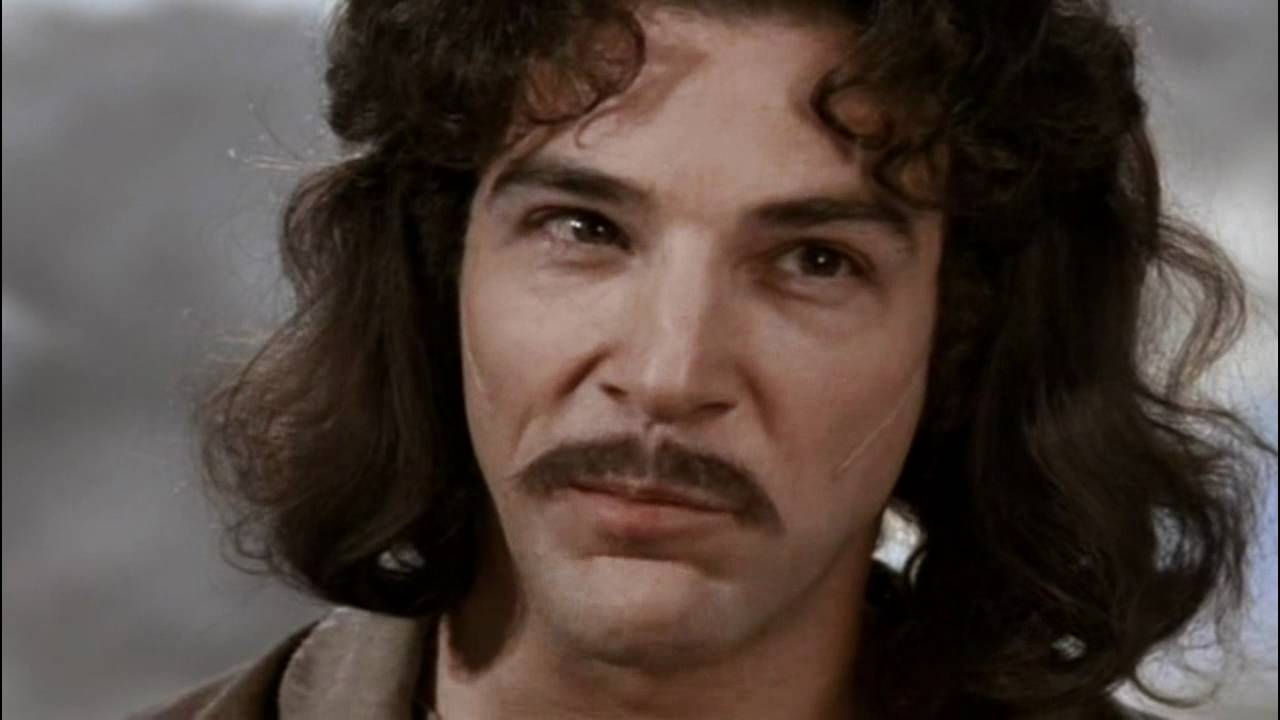

Hello, my name is Inigo Montoya – You look like a client, prepare to buy

TL;DR – Using cold calling and emailing could be a viable strategy for lead generation, […]

Israeli entrepreneurs: your edge as Israelis is distinct but limited, so go to your market!

For my upcoming non-recipe related posts I’ll start with TL;DR for those of you with […]

Your new startup idea is probably lacking the right starting point

If I had a dime for every startup idea I’ve heard, I’d probably have at […]

New-Age Corporate Innovation – Disruption or Disturbance?

Back in the old days (i.e. a few years ago), being an entrepreneur was “simple”. […]